For efficient management of business, where decisions carve paths to success or stagnation, the compass guiding leaders is financial reporting. Among the various tools at their disposal, one of the most pivotal is the comparison between budgeted projections and actual performance. This process, known as budget vs. actual reporting, serves as a litmus test for the fiscal health and strategic efficacy of an organization.

Understanding the Essence

At its core, budget vs. actual reporting juxtaposes the financial plan crafted by a company against its real-world financial outcomes. The budget, a meticulously crafted blueprint, outlines anticipated revenues, expenditures, and other financial metrics over a specified period. Actual reporting, on the other hand, presents the tangible results achieved during the same timeframe.

The Art of Budgeting

Budgeting is not merely about crunching numbers; it’s a manifestation of a company’s strategic vision and operational goals. A well-constructed budget aligns resources with objectives, enabling efficient allocation of capital and manpower. It serves as a roadmap, guiding decision-makers through the fiscal terrain, anticipating pitfalls and opportunities alike.

The Reality Check

Yet, the best-laid plans often encounter the harsh winds of reality. Actual performance seldom mirrors projections perfectly. Market fluctuations, operational hiccups, or unforeseen events can throw even the most meticulously crafted budget off course. Herein lies the importance of actual reporting—it unveils the true narrative behind the numbers.

Unveiling Discrepancies

Budget vs. actual reporting serves as a reality check, revealing discrepancies between expectations and outcomes. Variances, whether positive or negative, offer invaluable insights into the dynamics shaping a business’s financial trajectory. Positive variances indicate areas of overperformance, highlighting opportunities for optimization or resource reallocation. Conversely, negative variances signal areas requiring attention, prompting strategic reassessment or operational refinement.

ERP and BI Reporting Tools Help

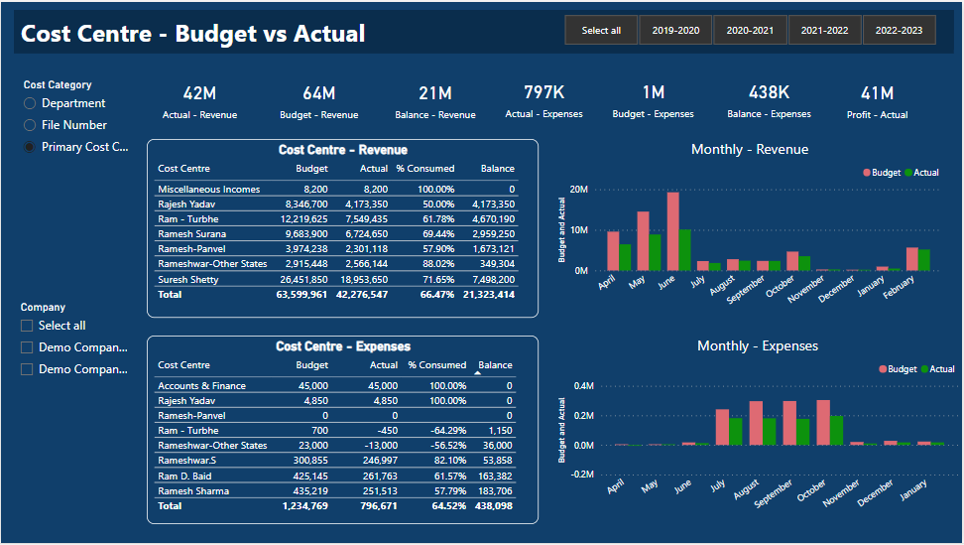

Beyond mere numerical disparities, budget vs. actual reporting offers a deeper analytical lens through which to evaluate performance. It facilitates trend analysis, identifying patterns and outliers that may inform future forecasting and decision-making. ERPs like Tally.ERP9, Tally Prime, Microsoft Business Central, Microsoft NAV, SAP B1, etc. and BI Reporting Tools such as Power BI, EasyReports, Qliksense, Tableau, etc. provide a framework in which you can upload budgets, record actuals and do analytical reporting of budget vs actual.

Harnessing Insights for Improvement

The true value of budget vs. actual reporting lies not in tallying numbers, but in harnessing insights for continuous improvement. By dissecting variances and dissecting root causes, businesses can refine their strategies, optimize resource allocation, and mitigate risks. It fosters a culture of adaptability and resilience, empowering organizations to navigate turbulent waters with confidence.

Conclusion

Budget vs. actual reporting is more than a financial exercise; it’s a strategic imperative. By bridging the gap between expectations and reality, it empowers organizations to chart a course toward sustainable growth and resilience. In an ever-evolving business landscape, where uncertainty is the only certainty, the ability to adapt and optimize is paramount.